How to avoid bad debts in the first place?

Tempest is in part a debt-buying firm. We buy old/hard to collect debt either outright or on a recovery split deal. But how do you avoid bad debts in the first place? These 6 tips will go some way to reducing the risk of bad debt and smoothing cash flow.

The main thrust of avoiding bad debts is avoiding bad customers. This is surely hard. Most of our commercial firms are in a sales-driven environment where the next sale can be hard to win and even harder to turn down. Neverthless, doing some homework or due diligence on the potential customer can save you big time in the future.

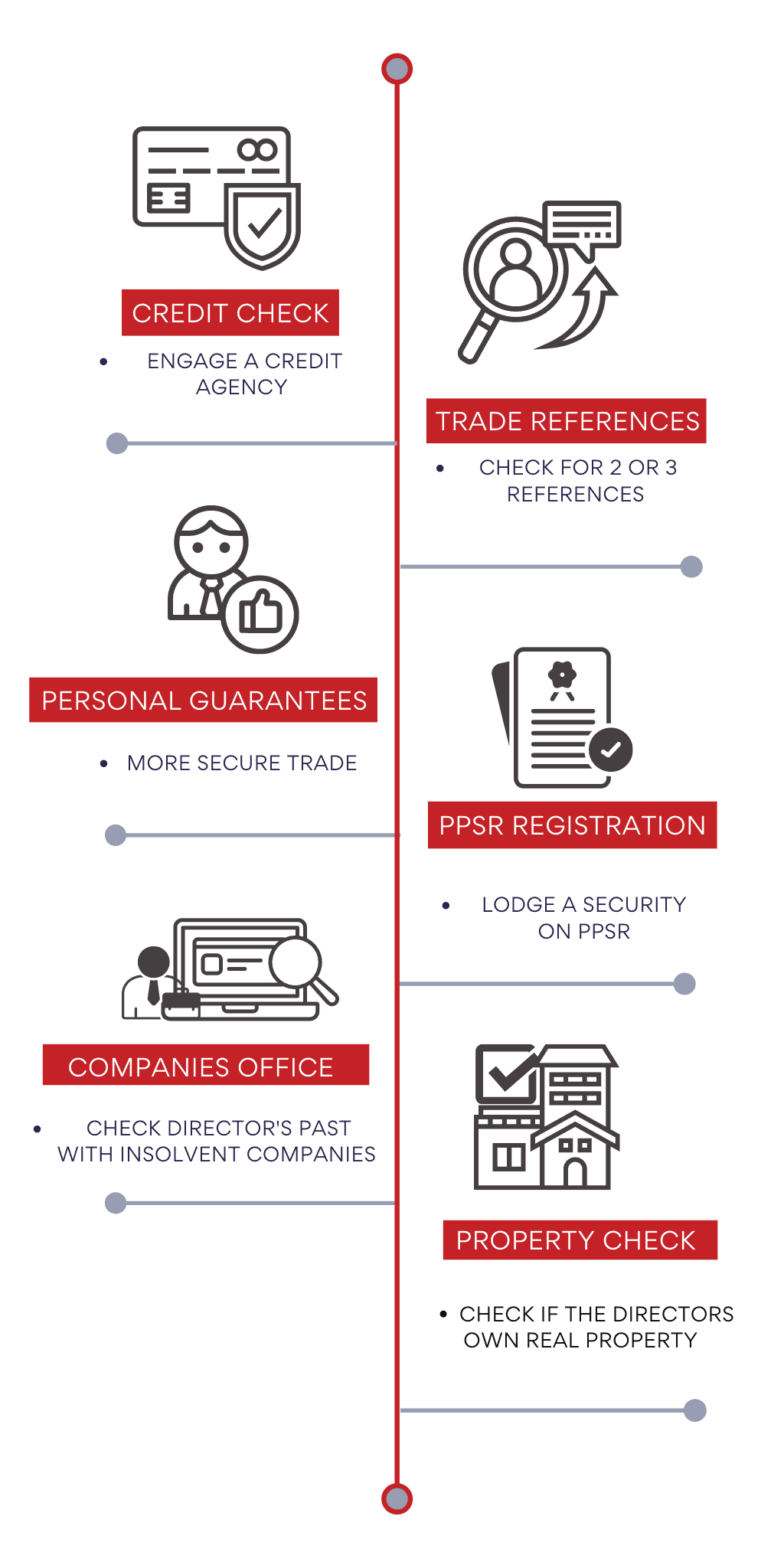

Here are some of the ways you can assess a customer’s creditworthiness and decide whether to accept a promise for payment later:

Credit check

Engage a credit agency like Gravity Credit Management to provide you with a credit report on the potential customer before opening an account.

Trade references

As part of your account sign up process, check at least 2 or 3 references to see if the customer pays on time. Also, remember customers will not usually offer up bad references, so the more you ask for the better.

Personal guarantees

You have more ways to get paid and potentially are more secure if your terms of trade/account have a personal guarantee,

PPSR registration

If you can, lodge security on the PPSR for any unpaid for goods/services that you have out there. (a lawyer or credit agency can assist you)

Companies office check

See if the director has been involved with past insolvent companies (some thorough credit checks should show these).

Property check

Check if your customer’s directors own real property (If they do, getting paid if something goes wrong may be easier.)

You know your business better than anyone, but a cautious approach to extending terms and credit can help you avoid a bad customer and bad debt.

However, if you have a bad debt that is just too hard to collect on, contact us before you decide to give up and write it off. It may be surprising at what you can get for the debt, or the recovery split that Tempest can offer. Get in touch with us at [email protected] or call us 0800 845 885.